What is an NPWP in Indonesia? NPWP for foreigners explained

The NPWP is an essential part of your expat journey in Indonesia, but it is also very often misunderstood.

Here is everything you need to know about the NPWP as a foreigner in Indonesia.

What is an NPWP in Indonesia?

The NPWP acronym in Bahasa Indonesia stands for Nomor Pokok Wajib Pajak. In plain English, you could translate it into your Tax Identification number.

In short, the NPWP is simply your Tax ID number in Indonesia that the Indonesian Tax Department (known as Pajak) will use to identify you.

Who needs to register for NPWP?

Everyone that is a fiscal resident in Indonesia must register for a NPWP.

That includes :

- All Indonesian citizens living in Indonesia

- All foreigners that are resident of Indonesia (KITAS & KITAP holders for the most part)

- Foreigners that lives more than 183 days / year in Indonesia

- All Indonesian companies and permanent establishments

So, the moment you live officially in Indonesia as a foreigner (holding a KITAS), you’ll become a resident, hence you’ll need a NPWP as you will be liable for taxes in Indonesia.

If you have a company in Indonesia, you’ll have two NPWP: one for your company, and one for yourself.

What does an NPWP allow you to do?

The NPWP is important and / or mandatory for several operations:

- Being able to work and earn money in Indonesia

- Reporting your taxes yearly to the Indonesian authorities for you and/or your company at resident rate (see next paragraph)

- Opening a bank account in Indonesia

- Buying land / Real estate (under your own or company name)

- Getting a loan from an Indonesian bank

- Being considered non-resident in your home country

- Prove your fiscal residency in Indonesia to any foreign financial institution (banks, brokerage accounts, payment gateway…)

Long story short, anything that involves taxes especially for large sums of money in Indonesia will usually require you to show your NPWP at some point.

Abroad, you’ll mostly use your NPWP to prove that you are fiscally established in Indonesia, which can avoid some hassles for double taxation or KYC policies.

Tax benefits for foreigners that have an NPWP

One aspect that is often overlooked with owning an NPWP as a foreigner, is that it can significantly lower your tax burden in Indonesia, including from your income that is locally sourced.

When you don’t have an NPWP as a foreigner, most taxes will have a surcharge added to it, which can quickly become significant.

For example, if you rent a villa or a house in Bali as a non-resident foreigner in Indonesia, you should normally pay 20% of the generated income to the Indonesian tax authorities if you don’t have an NPWP. However, if you DO have an NPWP, this number is reduced to 10% only, the usual rate Indonesian citizens and residents pay.

This doesn’t stop at your rental income generated in Indonesia. Foreigners with NPWP also have preferred tax rates (or free of surcharge if you prefer) for dividends, pensions and other royalties they might receive from Indonesia or abroad compared to the ones that don’t have the NPWP.

Obviously, this tax rebate isn’t a free gift. Having an NPWP does come with obligations since you become an Indonesian taxpayer for as long as you live in Indonesia. If you leave Indonesia for good and want to stop being a taxpayer, you’ll need to go through a financial audit organised by the government.

On the matter: How to (legally) live in Bali tax-free?

How do you register for your NPWP as a foreigner?

Getting your NPWP as a foreigner can be a little bit confusing, especially when you are new in Indonesia and not used to the role of each administrative entity.

Here is how it usually goes.

First thing first: the NPWP isn’t automatically given (yet), you NEED to request it

You could be thinking that once you get a residence visa such as a KITAS the NPWP will automatically follow, but this is unfortunately not the case just yet.

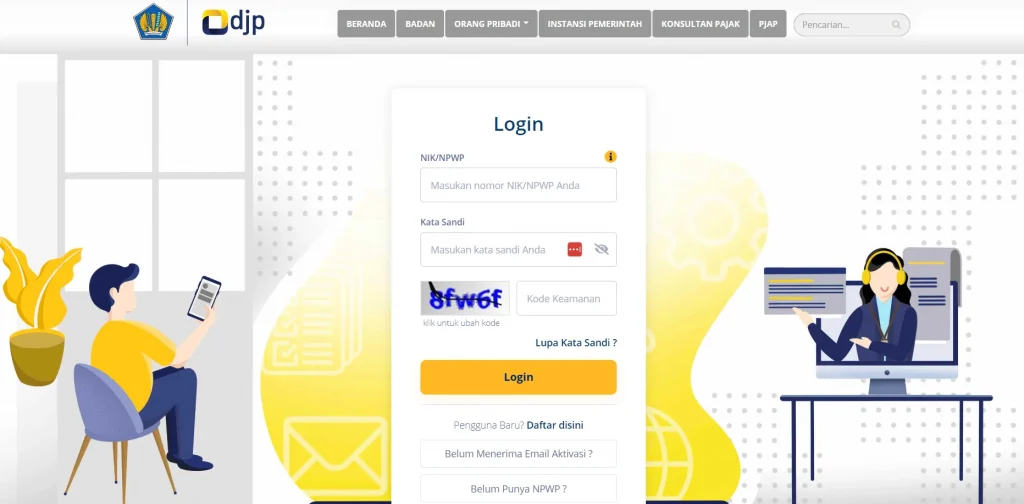

You will need to request your NPWP to the nearest tax department office.

But in order to do so, you will need to have your KITAS first.

If you already have a KITAS, an agent can register your NPWP for you

Once you have your KITAS (any kind: work, investor, family…), your agent can register your NPWP on your behalf.

You can also register on your own if you prefer, but the process can be a bit complicated for someone new to Indonesia, which is why most foreigners either let their employer do it (usually the HR department), or get an agent.

Regardless of who you use to register, once you register, you should receive:

- Your NPWP number / card, which is your official Indonesian Taxpayer number

- Your EFIN number: your electronic filing number aka the number associated with your yearly report

Conclusion

The NPWP is a central document that you surely will need if you plan to relocate in Indonesia.

You should definitely not sleep on it as it can open you a lot of doors to make your life easier in Indonesia.

It is your responsibility as an individual or a corporation to request for your NPWP (and to file your taxes properly), and you will be in legal and fiscal troubles if you fail to do so.

Get in touch with our team if you need assistance to get your NPWP.